Teaching your children about money is one of the most critical life skills you can impart. It equips them with the knowledge and competence they need to make sound financial decisions throughout their lives. The most effective way to introduce these core financial concepts is through a structured, age-appropriate allowance system.

Allowance, when tied to clear expectations and chores, transforms from a mere handout into a powerful simulation of the real world, teaching valuable lessons about work, income, and budgeting.

Why a Structured Allowance System Works

An effective allowance system provides a practical, low-stakes environment for children to learn financial management:

- Work Ethic & Income: Establishing a regular payday (e.g., weekly or bi-weekly) helps children connect effort (chores) directly to earning income.

- Budgeting & Prioritization: Using allowance as a teachable moment allows parents to discuss budgeting, saving, and making wise spending choices.

- The Three Pillars of Money: Encouraging children to divide their allowance into Savings, Spending, and Giving teaches them the three core functions of money simultaneously.

- Clear Expectations: Clearly defining the expected chores and the corresponding allowance amount minimizes arguments and fosters a sense of accountability.

Age-Appropriate Chores: Setting Them Up for Success

To ensure success and build confidence, chores must align with your child’s developmental stage. Tasks that are too hard cause frustration; tasks that are too easy don’t build competence.

| Age Group | Focus Skills | Chore Examples |

| Ages 3-5 (The Helper) | Simple clean-up, basic routines. | Putting toys away, helping set the table, feeding pets, putting clothes in the hamper. |

| Ages 6-8 (The Contributor) | Personal responsibility, multi-step tasks. | Making their bed, helping with laundry (sorting/folding), watering plants, clearing the table. |

| Ages 9-12 (The Manager) | Extended tasks, small-scale work. | Mowing the lawn (with supervision), babysitting younger siblings, helping with meal preparation, cleaning their bathroom. |

| Teenagers (13+) (The Independent) | Household maintenance, self-sufficiency. | Babysitting/pet care for neighbors, detailed yard work, planning and cooking family meals, household maintenance tasks. |

FREE DOWNLOAD: Master the Chores

Knowing which chores to assign is half the battle. To give you a clear roadmap for fostering responsibility from the toddler years through high school, we’ve created a handy guide:

FREE Guide: Mastering Age-Appropriate Chores Blueprint

This blueprint provides a comprehensive list of tasks by age group, helping you set expectations that build competence without overwhelming your child. It’s the first step to unlocking true financial and personal independence.

👉 DOWNLOAD YOUR FREE CHORES BLUEPRINT HERE! 👈

Take the Next Step: Structured Accountability

Once you know which chores to assign, the next step is establishing a structured system for tracking work and payment. This prevents arguments and makes the financial lessons clear and concrete.

Our most effective tools for establishing a seamless allowance system are:

The Chore Chart Scoreboard & Payday Agreement

This digital download bundle gives you the essential templates to implement a formal work-reward cycle instantly:

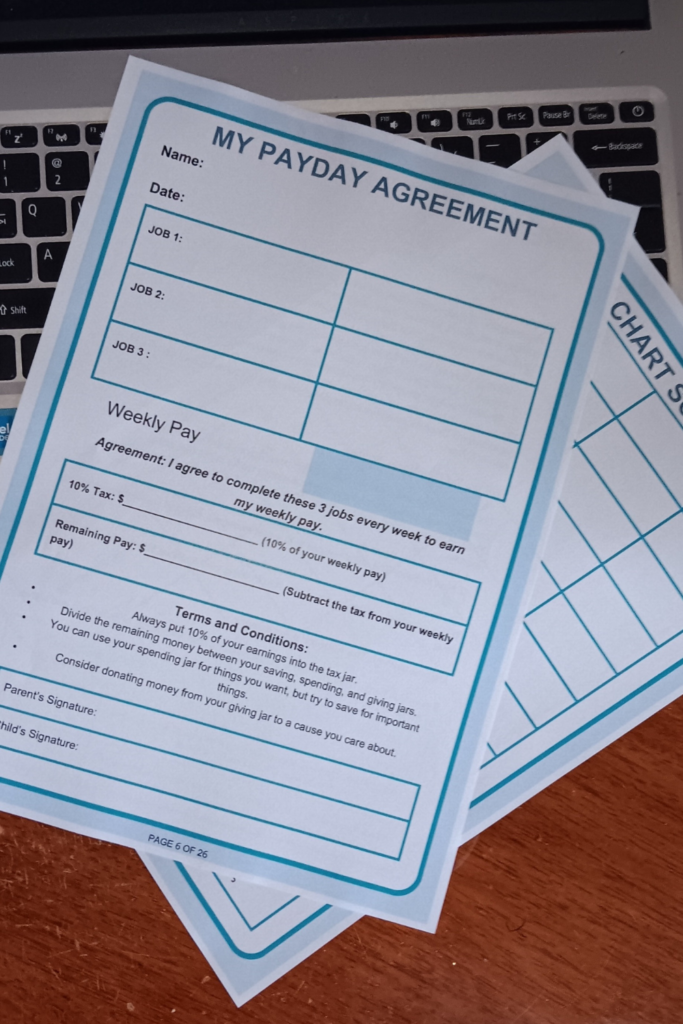

- The Payday Agreement: A customizable contract that clearly outlines expectations, weekly responsibilities, and the precise allowance amount. It also introduces the concept of taxes by including a 10% deduction, preparing them for the real world!

- The Chore Chart Scoreboard: A visual tool to easily track completed chores and the resulting earned allowance, fostering accountability.

By utilizing these structured resources, you can empower your children with the financial knowledge they need to thrive. Remember, teaching financial literacy is an ongoing process—be patient, be consistent, and most importantly, make it fun!

🛒 PURCHASE THE CHORE CHART SCOREBOARD & PAYDAY AGREEMENT TODAY! 🛒

Payday Agreement & Chore Chart Scoreboard Bundle: Kids Allowance System for Financial Literacy & Chore Accountability

Stop the chore wars and start building Money Masters!

The Payday Agreement & Chore Chart Scoreboard Bundle is the $5.99 digital download that brings structure to responsibility.

What you get:

- Payday Agreement: A simple contract for you and your child that defines three weekly jobs, introduces a hands-on “tax” (10%), and teaches money division into Saving, Spending, and Giving accounts.

- Chore Chart Scoreboard: A 10-week visual tracker for motivation and accountability.

This two-page tool is the perfect foundation for clear, stress-free financial education and earning!