Raising Financially Savvy Kids: Setting Up a Money Management System

Want to give your kids a head start in the world of finance? Teaching them about money management early is one of the most valuable lessons you can impart. Establishing a solid system now will make it much easier for them to develop healthy financial habits that will last a lifetime. After all, habits are hard to break, so starting early is key! This post will explore age-appropriate money management systems, starting with a simple 4-jar method for younger kids and transitioning to a more nuanced approach as they grow and begin earning.

The Power of Early Financial Education

Imagine your child confidently navigating their finances, making informed decisions, and achieving their financial goals. This isn’t a pipe dream – it’s achievable through early financial education. By introducing a money management system, you’re not just teaching them about numbers; you’re teaching them about responsibility, planning, and the power of delayed gratification.

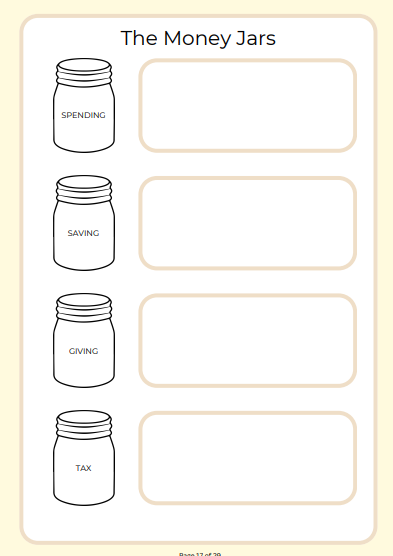

The 4-Jar System: A Foundation for Young Learners (Ages 5-12)

For younger children, simplicity is key. The 4-jar system provides a clear and visual way to understand different aspects of money:

- Spending Jar: This is for everyday purchases – treats, toys, or anything they want in the moment. It teaches them about making choices and managing immediate wants.

- Saving Jar: This jar is for bigger goals – a new bike, a special toy, or even a future trip. It teaches them the power of saving and working towards a target.

- Giving Jar: This jar is for charitable donations. It introduces the concept of giving back to the community and helping others.

- Tax Jar (or “Responsibility” Jar): While kids might not be paying taxes yet, this jar can represent the idea that a portion of money earned goes towards shared responsibilities. It can be used for things like contributing to family expenses or saving for a future “big kid” expense.

Making it Fun and Engaging:

- Personalize the Jars: Let your kids decorate their jars to make them feel ownership.

- Regular Allowance: Establish a regular allowance based on age and chores completed.

- Make it Visual: Watch the jars fill up! This provides a tangible representation of their progress.

- Talk About Money: Discuss different ways to earn and save money. Explain the difference between needs and wants.

Transitioning to a More Advanced System (Teenagers and Young Adults)

As your kids get older and start earning their own money (from part-time jobs, for example), it’s time to introduce a more complex system that reflects real-world financial realities. Here’s a suggested structure:

- Spending: This covers daily expenses, entertainment, and personal items.

- Short-Term Savings: This is for goals within a year or two – a new phone, a concert ticket, or a weekend getaway.

- Long-Term Savings: This is for larger goals that take more time to achieve – a car, college, or a down payment on a house.

- Splurging: This is a designated amount for occasional treats or non-essential purchases. It teaches them that it’s okay to indulge sometimes, but within a budget.

- Emergency Fund: This is crucial for unexpected expenses – a broken phone, a flat tire, or a sudden change in plans.

- Investing: This is where they can start learning about growing their money over time through stocks, bonds, or other investments. Even small amounts can make a big difference over the long term.

Why Start Now?

The beauty of establishing a money management system early is that it becomes a habit. Just like learning to ride a bike, the earlier they start, the more natural it becomes. Trying to change ingrained spending habits later in life can be challenging. By instilling these skills now, you’re setting them up for a lifetime of financial success.

Resources:

Our Saving Seed Money Bundle for kids aged 5 to 12 explores the 4-jar method in a fun and engaging way. Keep an eye on Lilac Bloom Digital for future resources and courses designed specifically for teenagers and young adults. We’re committed to helping you raise financially savvy kids!