Teaching kids about money shouldn’t wait until they leave home. The allowance isn’t just a handout; it’s a safe, small-scale simulation of adult financial life. Structured correctly, it teaches budgeting, earning, and delayed gratification without the stress of real-world consequences.

This post will detail why introducing a formal allowance is critical, how to set it up like a real job, and introduce the powerful Four-Jar Money Management System that sets kids up for life.

Why Allowance is Your Child’s First Financial Classroom

Introducing a consistent allowance, especially one tied to real-world expectations, is the single best way to teach financial literacy early.

The Core Benefits of an Allowance

- Teaches Value and Effort: Tying money to effort through a chore chart teaches the foundational lesson that money is earned, not simply given (the “Earned” or “Combined” model is highly recommended).

- Develops Decision-Making: When they have their own money, they have to decide: Is this new toy worth spending my savings on? This builds confidence and ownership over their choices.

- Fosters Responsibility: They learn to budget for their own wants. When they run out of spending money, it’s a natural consequence, not a parental lecture.

- Promotes Delayed Gratification: Saving up for a big purchase over several weeks or months teaches them to wait for what they want, a key predictor of adult financial success.

Implementing Allowance: The Real-World Payday System

To prevent allowance from feeling like an entitlement, structure it like a job with clear expectations and a regular “payday.”

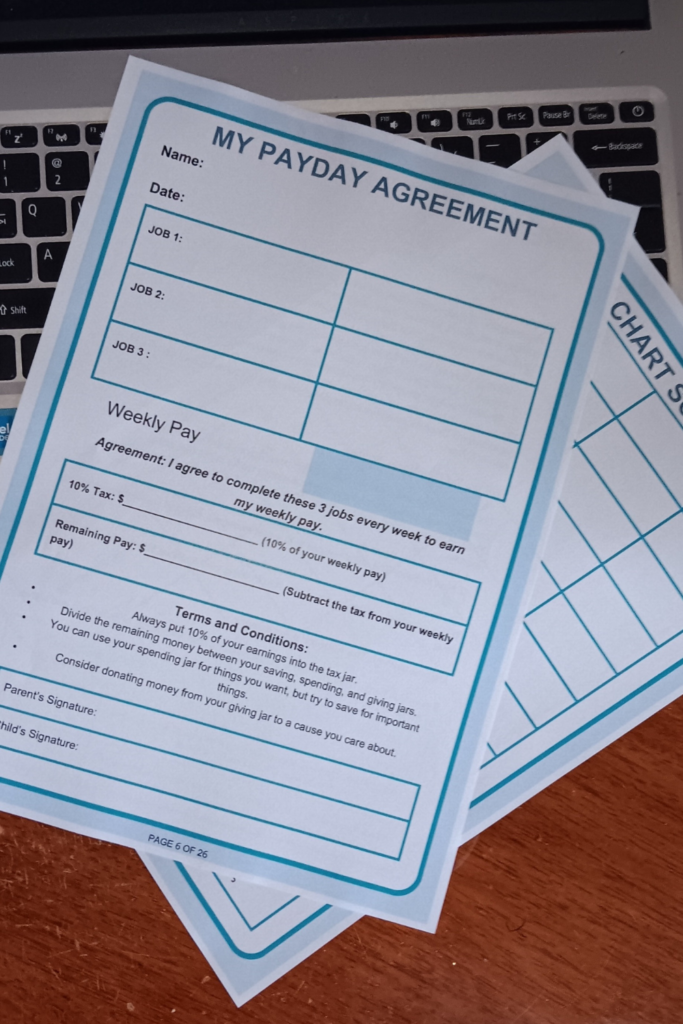

1. The Payday Agreement

This is your child’s first contract! Sit down and formally discuss the terms:

- The Amount: Determine a sustainable weekly or bi-weekly amount based on your budget and their age/needs.

- The Expectations: Clearly define which purchases the allowance will cover (e.g., specific toys, movie tickets, apps) so they can budget for them.

- The Paycheck: Set a fixed “payday” (e.g., Friday evening). Consistency is key to teaching reliability.

2. The Chore Chart Scoreboard

Use a Chore Chart or Scoreboard to visually track responsibilities and link effort to the allowance.

- Mandatory vs. Earning Chores: Separate the two.

- Mandatory: Basic life tasks that are part of being a family member (e.g., making their bed, cleaning their room). These are done out of responsibility and are not paid.

- Earning Chores: Extra tasks that go above and beyond their daily responsibility (e.g., washing the car, weeding the garden). These tasks earn the agreed-upon allowance amount.

- Why a Scoreboard is Essential: It’s a visible record. Kids can clearly see their progress throughout the week, increasing accountability and providing motivation before payday.

Payday Agreement & Chore Chart Scoreboard Bundle: Kids Allowance System for Financial Literacy & Chore Accountability

Stop the chore wars and start building Money Masters!

The Four-Jar Money Management System

This system is the most powerful tool you can introduce, as it teaches the four core functions of money simultaneously:

Implement a physical system using four clear jars, envelopes, or separate labeled digital accounts.

1. 💼 Tax (or Future/Long-Term Saving)

- The Goal: To simulate taxes and teach the concept of money being taken out before you get to spend it. As they get older, this can transition into a long-term fund (college, first car, etc.).

- Action: Immediately allocate 10% of their allowance here.

2. 🛍️ Spending (or Short-Term Goals)

- The Goal: To cover immediate wants and short-term purchases (toys, snacks, entertainment). This is where they learn to manage scarcity.

- Action: Allocate the largest portion here, typically 50-60%.

3. 🏦 Saving (The Wealth Builder)

- The Goal: To save for medium-term goals (e.g., a new game console, concert tickets). This jar reinforces delayed gratification and compound interest (if you offer a small “parent match” incentive).

- Action: Allocate 20% here.

4. 🎁 Giving (The Generosity Jar)

- The Goal: To teach philanthropy and empathy. The money can go towards a charity, a birthday gift for a sibling, or a community project.

- Action: Allocate 10-20% here.

🔥 Ready to Launch Your Allowance System?

Setting up a robust allowance system shouldn’t be complicated. We’ve done the heavy lifting for you!

Download Your Resource: The Allowance Blueprint

This toolkit includes everything you need to implement this system immediately:

- Printable Chore Chart & Payday Agreement templates.

- Ready-to-use ratios for the Four-Jar System.

- Troubleshooting guide for common challenges (e.g., “I lost all my money!”).

Click here to get The Allowance Blueprint and launch your child’s first financial classroom today!

The Allowance Blueprint

The Allowance Blueprint for Kids is a comprehensive, structured system designed by a working mom and social worker to instill essential financial literacy and responsibility in your children.

More than just a book about pocket money, this guide provides a step-by-step roadmap to create an engaging, educational allowance program that breaks free from the tiring “I want” arguments.