Unlock Your Child’s Financial Confidence with the Fun, Hands-On Blueprint for Ages 5-12!

“Worried about your child’s financial future?”

“In today’s fast-paced world, it’s easy for kids to develop instant gratification habits. Are you struggling to teach your child the value of money, the importance of saving, or how to make responsible spending decisions?”

“That’s where The Saving Seed Money Blueprint comes in designed for children aged 5-12, this comprehensive blueprint will transforms complex financial concepts into exciting, hands-on learning experiences for the whole family.”

“Kids who learn about money early are more likely to save and invest.”

The Problem We Solve

In today’s fast-paced world, it’s easy for kids to develop instant gratification habits. Are you struggling to teach your child the value of money, the importance of saving, or how to make responsible spending decisions?

Many parents want to give their 5–12-year-old the foundational financial literacy skills they need to thrive, but don’t have the tools to make it stick—without the lectures!

The truth is: Financial literacy is not just about money; it’s about life skills.

Introducing: The Saving Seed Money Bundle for Kids

This comprehensive bundle transforms complex financial concepts into exciting, hands-on learning experiences for the whole family, designed specifically for children aged 5–12.

What Makes This Blueprint a Game-Changer?

| Feature | Core Benefit |

| The Saving Seed Money Workbook (21 Engaging Worksheets) | These are fun, interactive challenges that make complex money concepts click for your child. They’ll light up as they learn about saving, spending, and giving. |

| The Saving Seed Money Guide (10 Guided Parent Lessons) | Your Personal Money Mentoring Blueprint! This guide gives you the confidence and tools to teach financial concepts effectively, even if you’re not a finance expert! No more guessing—just clear, actionable steps for impactful conversations. |

| Hands-On, Interactive Activities | Transform abstract ideas into memorable experiences through games, thought-provoking conversation starters, and activities that spark lasting understanding. |

| Focus on Life Skills | Beyond just money, your child will develop crucial life skills like critical thinking, responsible decision-making, and the power of delayed gratification—fostering a growth mindset that celebrates every small success. |

|  |

Topics Explored in The Saving Seed Money Blueprint:

The years before age 12 are the critical window for building financial habits that last a lifetime. The Saving Seed Money Blueprint is your essential guide to cultivating a strong financial foundation for your child, moving them beyond just asking for money to actively managing, growing, and respecting it.

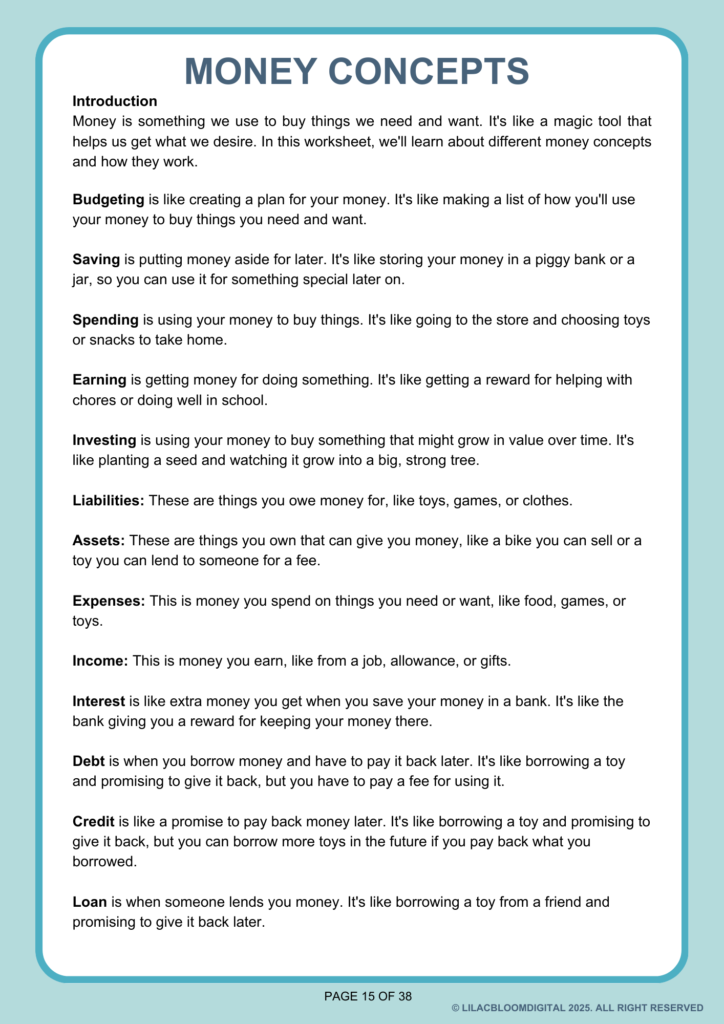

This comprehensive blueprint focuses on four key areas of financial discovery:

🌱 The Financial Mindset: Building Positive Beliefs

We dive deep into the psychology of money to help your child develop a healthy relationship with wealth.

- Types of Money Mindsets: Learn to identify common mindsets like the Cautious Saver, Impulsive Spender, and Generous Giver to guide your child effectively.

- Fixed vs. Growth Mindset: Discover the power of a Growth Mindset to view financial challenges as opportunities for learning and problem-solving, rather than limitations.

- Earning Value: Connect effort and work to the concept of Earning Value.

- Money Mindset Quiz: A practical quiz is included to help pinpoint your child’s current beliefs and attitudes toward money.

⚖️ Prioritization & Patience: Making Smart Choices

Mastering the foundational skills of making informed financial decisions.

- Wants vs. Needs: Learn the crucial difference between things they must have (Needs) and things they would like to have (Wants).

- Delayed Gratification: Build the discipline and patience needed to save for bigger goals instead of buying small, immediate items.

- The Smart Shopper: Develop strong Financial Decision-Making skills to become a smart shopper.

💡 Smart Spending & Saving: The Magic of Growth

Unlock the practical skills for managing and growing money over time.

- The Power of Early Saving: Understand that starting early is the single most important decision for a child’s financial future.

- The Penny Power: Simple Compounding: Learn the “magic” of Simple Compounding—where money begins to grow itself.

- The Little Side Gig: Explore earning money beyond chores and allowance.

- Investing Detective: Introduce basic concepts related to investing.

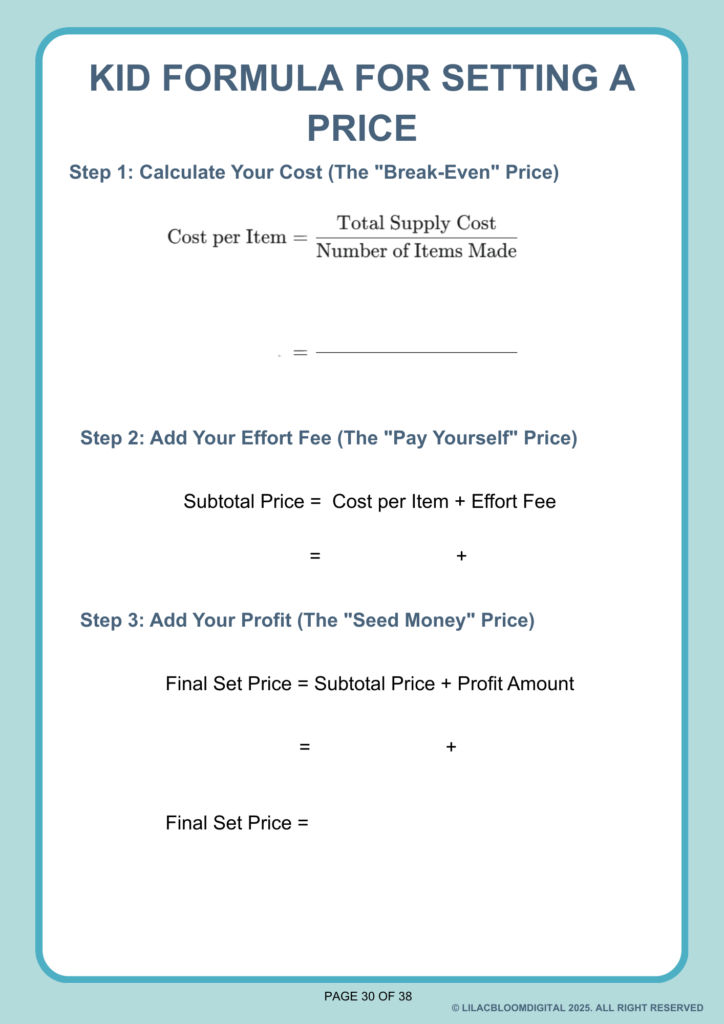

✏️ Budgeting Mastery: The Recipe for Resource Management

Learn how to manage resources effectively with practical tools and exercises.

- The Budget Goal: Understand what a budget is and its main goal.

- The Basic Budgeting Recipe: Learn the formula for effective resource management.

- Mini Budget Chef Planner & Grocery Comparison: Real-world tools to apply budgeting to everyday decisions, like cooking and shopping.

- Real-World Trade-Offs: Applying budgeting skills to manage resources effectively.

|  |  |

🗺️ The Journey Begins with a Check-in!

Start your journey by completing the “My Money Journey” quiz and reflection tool (found in the accompanying workbook, pages 5-8) to accurately assess your child’s current financial knowledge and pinpoint where they need to focus.

Your Child will gain the confidence and critical thinking skills needed to handle the complex financial decisions of their teenage and adult years.

The Saving Seed Money Blueprint

Plant the Seed, Grow the Fortune!

Unlock your child’s financial potential with The Saving Seed Money Blueprint. This program transforms kids aged 5-12 from spenders to smart managers by teaching them the power of a Growth Mindset , mastering Wants vs. Needs , and harnessing the magic of compounding. Start their journey before age 12—the critical window for building lifelong money habits!

How it Works: Simple Steps to Financial Confidence

- Download & Print: Instantly access your bundle upon purchase (Digital PDF).

- Explore Together: Dive into the colourful workbook and parent guide with your child.

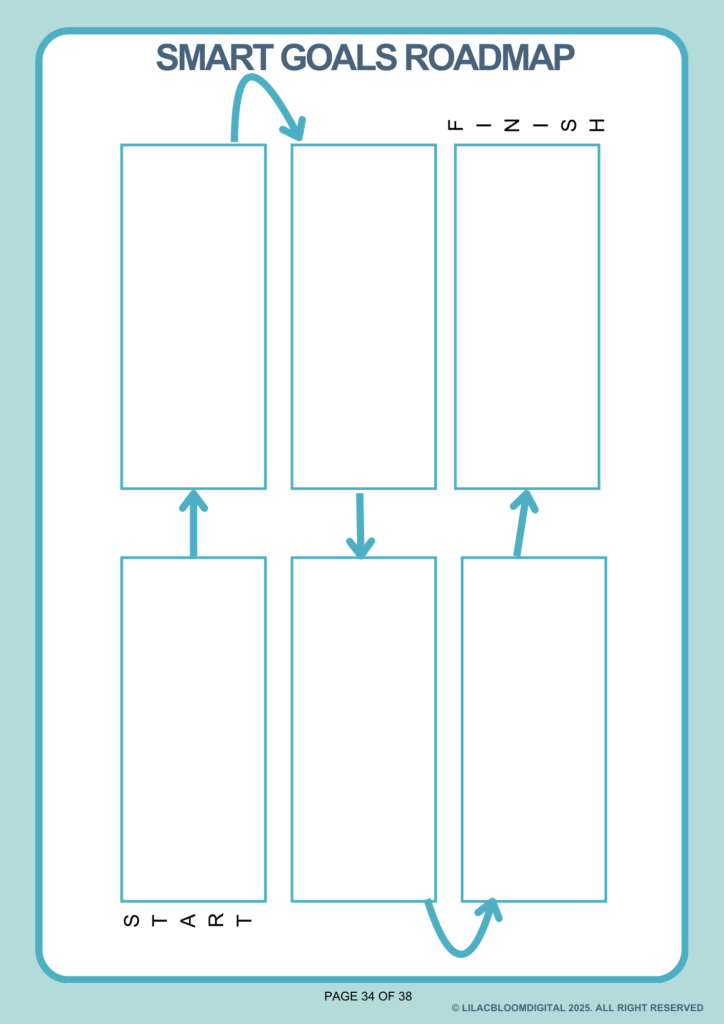

- Set & Track Goals: Use the fun worksheets to help your child choose and track their savings goals.

- Engage & Grow: Facilitate the interactive lessons and watch your child’s money skills blossom!

- Celebrate Successes: Acknowledge their achievements and reinforce positive habits.

YES! Give My Child the Gift of Financial Literacy!

The Saving Seed Money Blueprint

Plant the Seed, Grow the Fortune!

Unlock your child’s financial potential with The Saving Seed Money Blueprint. This program transforms kids aged 5-12 from spenders to smart managers by teaching them the power of a Growth Mindset , mastering Wants vs. Needs , and harnessing the magic of compounding. Start their journey before age 12—the critical window for building lifelong money habits!

Our Money-Back Guarantee: (Risk-Free!)

We’re so confident in The Saving Seed Money Blueprint that we offer a 30-day money-back guarantee. If you and your child aren’t thrilled with the learning and progress, simply let us know for a full refund. No questions asked.

Frequently Asked Questions

| What age is this bundle suitable for? | This comprehensive program is specifically designed for children aged 5–12 years old, providing flexible lessons that grow with your child’s understanding. |

| Is this a physical product or a digital download? | This is an instant Digital Download (PDF). The bundle is structured with a Guide for Parents and a Workbook for Kids. As a digital download, you receive two key benefits: a low purchase cost and the ability to print off multiple copies of the workbook for repeatable use, making it budget-friendly for families with multiple children. |

| How long does it take to go through the lessons? | The lessons are designed to be entirely flexible, allowing you to go at your family’s pace. You can choose to cover one lesson per week for a sustained learning experience, or you can spread them out to fit your schedule. |

| Do I need to be a financial expert to use this? | Absolutely not! The dedicated Parent Guide breaks down every financial concept into clear, actionable steps, making it easy for any parent—regardless of their financial background—to teach their kids about money with confidence. |

| Can I print this multiple times for different children? | Yes! The Blueprint was designed to be printable for repeatable personal household use. Print copies for each child and use the templates again and again as they grow and set new goals. |

| Does the program develop other life skills? | Yes, beyond financial literacy! While teaching money is the main goal, the program naturally fosters crucial, transferable life skills, including responsibility, self-control (through delayed gratification), and problem-solving (through budgeting challenges). |