Why Early Money Conversations Matter

We all want our children to grow into responsible, capable adults, and a crucial part of that journey involves understanding money. Financial literacy isn’t just about balancing a checkbook; it’s about developing a healthy relationship with money, making informed decisions, and building a secure future. The good news? You don’t need to be a financial guru to teach your kids about money. By starting early and making it a natural part of everyday life, you can equip them with invaluable skills that will last a lifetime.

The Power of Starting Early: Why Age Doesn’t Matter (When It Comes to Learning About Money)

Think of financial education like learning a language. The younger you start, the more natural and ingrained it becomes. Introducing money concepts early on provides several powerful benefits:

- Builds a Strong Foundation: Just as toddlers learn to count before they can do calculus, early exposure to money concepts lays the groundwork for more complex financial understanding later on. They’ll grasp basic ideas like earning, spending, and saving long before high school.

- Normalizes Money Conversations: When money is discussed openly and regularly, it removes the mystery and potential anxiety surrounding it. Children learn that money is a tool, not a taboo subject, fostering a healthy and realistic perspective.

- Develops Crucial Life Skills: Learning about money isn’t just about finances; it teaches patience (delayed gratification), decision-making, goal setting, and responsibility. These are life skills that extend far beyond their piggy bank.

- Reduces Future Stress: Financially literate individuals are often less stressed about money in adulthood. By teaching these skills early, you’re giving your children a head start on a more secure and less anxious financial future.

- Empowers and Protects: Understanding money helps children resist peer pressure for unnecessary purchases and recognize potential financial pitfalls. It empowers them to make smart choices for themselves.

Simple Money Conversations: Making it Part of Their World

You don’t need a formal lesson plan or a whiteboard to talk about money. The most effective conversations happen organically, in the midst of everyday life.

- “Mommy’s working to earn money for our groceries.” Explain that money is earned through work.

- “We have enough money for one toy today. Which one will you choose?” Introduce the concept of limited resources and making choices.

- “If you save your allowance, you can buy that bigger toy next month.” Teach delayed gratification and saving for goals.

- “This money goes to help keep our house warm.” Introduce bills and the cost of living.

- “Let’s put some coins in the giving jar to help others.” Instill the value of generosity and social responsibility.

Incorporating Money Conversations into Everyday Life for Kids

Everyday moments are prime opportunities for financial learning.

- Grocery Store Adventures:

- Early Childhood: Let them put items in the cart. “We need apples, and they cost three dollars.” Use pretend money for fun.

- Elementary School: Give them a small budget for a snack and let them choose. “Can we afford the cookies AND the juice?”

- Middle School: Discuss unit pricing. “Which cereal is a better deal per ounce?”

- Chores and Allowance:

- The Allowance Blueprint: This is where an allowance system truly shines! It provides a tangible way for kids to earn, save, and spend. Instead of just handing out money, tie it to responsibilities.

- Ready to take the guesswork out of setting up an effective allowance system that teaches real-world money management? Our Allowance Blueprint offers a step-by-step guide to introducing basic money management for kids, helping them understand the value of earning and the power of their own financial choices. Click here to learn more!

- Birthday and Holiday Gifts:

- Wants vs. Needs: Before a birthday, discuss the difference between “wants” (a new video game) and “needs” (new shoes for school). “You really want that toy, but do you need it?”

- Budgeting Gifts: “We have $20 for Grandma’s gift. What can we get that she’ll love and stays within our budget?”

- Outings and Experiences:

- Planning a Trip: Involve them in budgeting for a family outing. “The museum tickets cost this much, and we’ll need money for lunch. How much do we have left for souvenirs?”

- Restaurant Choices: “Eating out costs more than eating at home. Let’s decide if this is a special treat or if we should save for something else.”

Start Early and Make it Age-Appropriate:

- Early Childhood (Preschool and Kindergarten): Introduce basic concepts of money through everyday activities. Let them “pay” for groceries with pretend money or help you count change. “Look, we have two quarters for the gumball machine!”

- Elementary School: Discuss needs vs. wants, explain how money is earned, and introduce the concept of saving goals. Involve them in budgeting for small purchases. “If you save $5 a week, you’ll have enough for that new book in three weeks!”

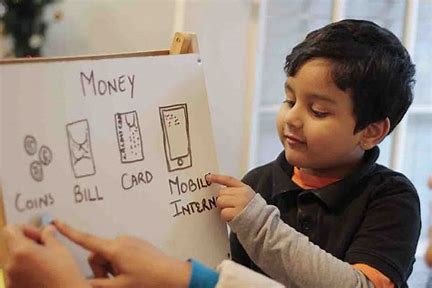

- Middle School: Expand on saving and budgeting. Teach them about different payment methods, responsible credit card use (if applicable), and basic investing concepts. “Let’s compare these two phones – one is cheaper upfront, but the other might save us money on a data plan in the long run.”

- High School: Help them navigate real-world financial situations like opening a bank account, budgeting for college or future expenses, and understanding taxes. “Here’s how to set up a checking account, and let’s talk about how much you might need for college textbooks.”

Make it Real and Engaging

- Involve them in financial decisions: Discuss household expenses at an age-appropriate level. Let them contribute to grocery lists or participate in planning family outings within a budget.

- Use games and activities: Board games like Monopoly, budgeting apps, or creating a chore chart with an allowance system can make learning fun and interactive.

- Connect it to their interests: If your child loves video games, discuss in-app purchases and responsible spending habits online. If they’re into fashion, talk about quality versus quantity.

Lead by Example

- Be open and honest about your finances: Discuss your budget and spending choices in a way they can understand. “We’re saving for our summer vacation, so we’re making coffee at home this month instead of buying it out.”

- Model good financial habits: Show them the importance of saving, paying bills on time, and avoiding impulse purchases. Let them see you comparing prices or setting aside money for a goal.

- Turn mistakes into learning opportunities: If you overspend, discuss it with them and create a plan to get back on track. “Oops, I spent a little too much on that, so we need to cut back in this area to balance our budget.”

Focus on Values, Not Just Numbers:

- Teach them about delayed gratification: Explain the importance of saving for something they really want and resisting instant gratification. The joy of achieving a saving goal is a powerful lesson.

- Incorporate social responsibility: Discuss charitable giving and how money can be used to help others. Set aside a “giving” jar for a cause they care about.

- Help them develop a healthy relationship with money: Money is a tool, not a source of happiness. Teach them the value of hard work and responsible spending, emphasizing that true wealth is more than just dollars and cents.

Ready to Deepen Your Child’s Financial Understanding?

While everyday conversations are vital, sometimes you need a more structured approach to ensure comprehensive learning. That’s where our specialized resources come in.

- The Saving Seed Money Bundle for Kids is available now! This invaluable resource provides you with the tools and strategies to confidently teach your children about financial literacy, no matter their age.

- For the ultimate foundation in financial wisdom, explore The Saving Seed Money Bundle for Kids! This comprehensive bundle goes beyond the basics, diving deep into:

- Money Mindset: Cultivating a positive and empowered view of money.

- Money Concepts: Understanding everything from currency to financial institutions.

- Spending & Saving Habits: Developing wise habits that will serve them for life.

- SMART Goals: Learning to set and achieve specific, measurable, achievable, relevant, and time-bound financial goals.

- Wants vs. Needs: Mastering the critical distinction to make thoughtful spending choices.

By incorporating these tips and utilizing our expertly designed resources, you can equip your child with the knowledge and skills they need to make sound financial decisions throughout their lives, setting them up for a future of financial confidence and success.

Don’t wait to plant the seeds of financial literacy. Purchase The Saving Seed Money for Kids Bundle today and watch your children’s financial understanding grow!