We all want our kids to understand the value of money, but simply telling them isn’t enough. The best lessons are learned through experience, and that’s where a savings plan comes in. It’s not just about accumulating money; it’s about instilling crucial life skills like hard work, saving, and delayed gratification.

Choosing the Dream

The first step is to let your child choose something they really want. It could be a new bike, a gaming console, or even a trip to their favourite theme park. The key is that the goal should be something that excites them and motivates them to work for it.

Setting the Budget

Once the goal is set, it’s time to break down the cost and create a savings budget. This is where you can introduce basic math concepts like addition, subtraction, and percentages in a real-world context. Help your child calculate how much they need to save each week or month to reach their goal within a reasonable timeframe.

Earning and Saving

Now comes the hard work part. Brainstorm with your child different ways they can earn money. This could involve doing chores around the house, helping neighbours with yard work, or even starting a small business like selling lemonade or handmade crafts. Encourage them to be creative and resourceful.

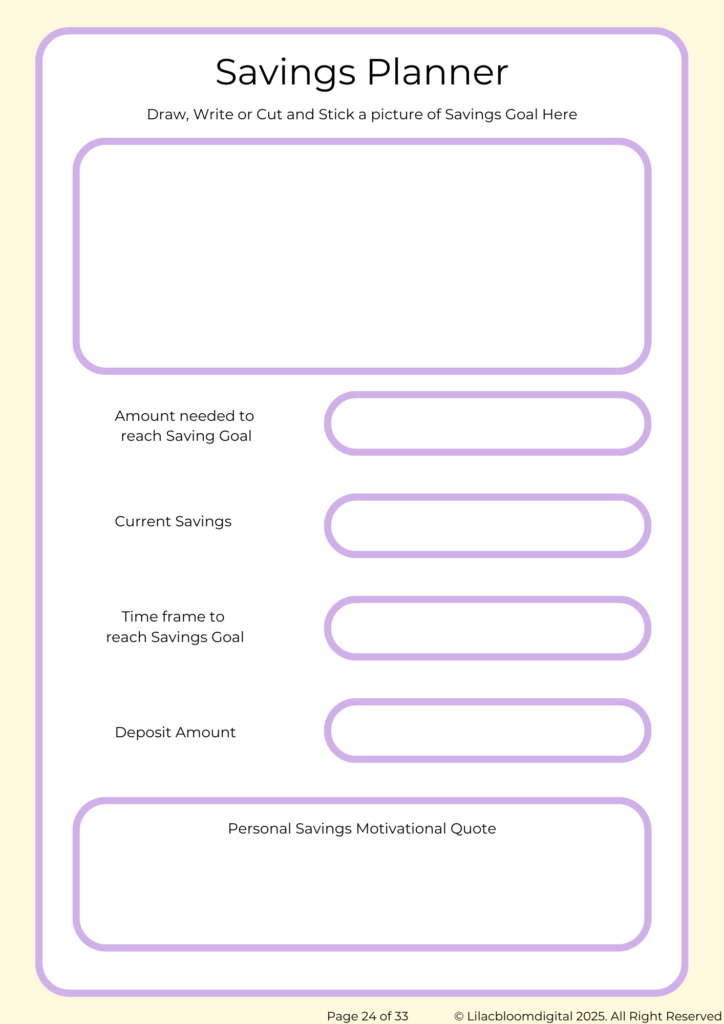

Tracking Progress

Create a visual representation of their progress. This could be a chart, a piggy bank, or even a simple spreadsheet. Seeing their savings grow over time will reinforce their efforts and keep them motivated.

Understanding Delayed Gratification: Wants vs. Needs

The concept of delayed gratification is a cornerstone of financial maturity. At its heart, it’s the ability to resist the temptation for an immediate reward in favour of a later, more substantial reward. For kids, this is a challenging but essential life skill. The most effective way to teach this is by helping them understand the difference between wants and needs.

- Needs are the essentials for life—things like food, shelter, and clothing.

- Wants are the luxuries—the new toy, the sugary treat, or the latest gadget.

Impulsive spending is the opposite of delayed gratification. It’s giving in to those immediate “wants,” often on unnecessary items, which can significantly impact a child’s relationship with money. By choosing to save for a big goal instead of buying a small toy on every shopping trip, they are practicing delayed gratification and reinforcing the positive habit of prioritizing what truly matters.

The Power of Delayed Gratification

As your child starts to see their savings accumulate, they’ll also learn this valuable lesson. They’ll realize that by sacrificing immediate wants, they can achieve something bigger and more rewarding in the future. The excitement of finally purchasing that gaming console or going on that special trip is a direct and powerful reward for their hard work and patience. This positive reinforcement is crucial because it makes the act of delayed gratification feel not like a sacrifice, but a satisfying accomplishment.

This skill isn’t just for childhood. The ability to delay gratification is a powerful predictor of future success. In adulthood, it translates into avoiding significant debt, saving for a home, or building a comfortable retirement. By teaching your kids this now, you are giving them the tools they need to make wise financial decisions for the rest of their lives.

Further Exploration

This blog post is just a starting point. I created “The Saving Seed Money Blueprint” to teach my children about financial literacy and decide to share it with the world. It delves into so much more than just creating saving plans and offers the necessary resources to teach your child about financial literacy with a focus that it is not all about numbers. It’s worth checking out.

Click here to Learn more about The Saving Seed Money Blueprint

Conclusion

Creating a savings plan with your child is a fantastic way to teach them valuable life lessons about money management, hard work, and delayed gratification. It’s an investment in their future and a way to empower them to achieve their dreams.