We’ve all been there: the endless cycle of nagging, the “I’ll do it later” excuses, and the frustration of feeling like a broken record when it comes to household responsibilities. If you are looking for a simple, effective way to transform chores from a point of contention into a valuable life lesson, it’s time to introduce a Payday Agreement.

At Lilacbloomdigital, we believe that financial literacy starts with understanding the connection between effort and reward. By moving away from “nagging” and toward “earning,” you empower your children to take ownership of their roles in the family.

Why a Payday Agreement is Essential for a New Allowance

When you first introduce an allowance, it can be tempting to just hand over a set amount of cash every week. However, without a clear structure, this often leads to a sense of entitlement rather than responsibility. Here is why a formal agreement is a game-changer:

- Sets Clear Expectations: It defines exactly what “success” looks like by listing specific jobs to be completed.

- Introduces the “Work-Reward” Cycle: Kids learn that money doesn’t just appear; it is earned through consistent effort.

- Eliminates Arguments: Because the terms are signed and agreed upon, there is no room for debate when jobs aren’t finished—the “paycheck” simply isn’t earned.

- Normalizes Financial “Adulting”: By including real-world concepts like taxes (10%) right from the start, children aren’t shocked by these realities later in life.

How to Implement Your Payday Agreement

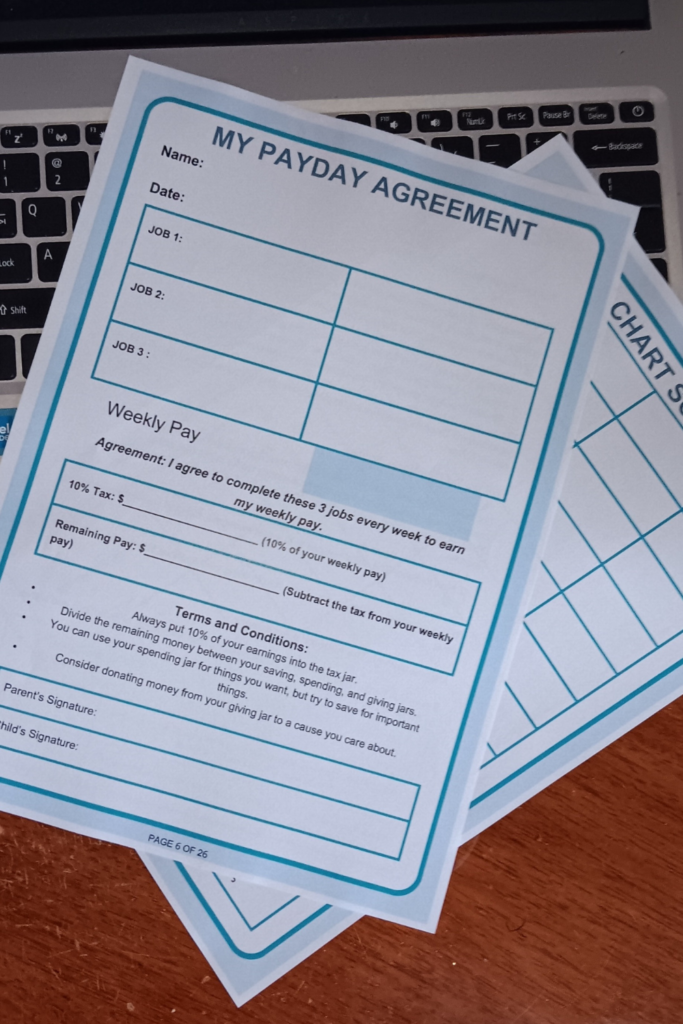

Using our Payday Agreement template, you can set up a stress-free system in four simple steps:

- Define the Roles: Sit down with your child and choose three specific “jobs” they are responsible for each week.

- Calculate the Pay: Determine a weekly pay amount. Once decided, use the template to calculate a 10% Tax. This introduces the concept that a portion of our earnings goes back to the community or “the house”.

- Establish the Terms and Conditions: Use the agreement to decide how the “Remaining Pay” will be divided between Saving, Spending, and Giving jars.

- Seal the Deal: Have both the parent and child sign the document. This physical signature creates a sense of pride and formalizes their commitment.

Track Success with the Chore Chart Scoreboard

An agreement is only as good as its follow-through. To keep the momentum going, pair your agreement with a Chore Chart Scoreboard. This visual 10-week tracker allows kids to see their progress in real-time, providing the motivation they need to stay accountable without you needing to remind them every five minutes.

Ready to Upgrade Your System?

The Payday Agreement & Chore Chart Scoreboard Bundle is the perfect $5.99 starting point for any family looking to end the chore wars once and for all. It’s a basic, hands-on way to teach earning, taxes, and budgeting.

Payday Agreement & Chore Chart Scoreboard Bundle: Kids Allowance System for Financial Literacy & Chore Accountability

Stop the chore wars and start building Money Masters!

The Payday Agreement & Chore Chart Scoreboard Bundle is the $5.99 digital download that brings structure to responsibility.

What you get:

- Payday Agreement: A simple contract for you and your child that defines three weekly jobs, introduces a hands-on “tax” (10%), and teaches money division into Saving, Spending, and Giving accounts.

- Chore Chart Scoreboard: A 10-week visual tracker for motivation and accountability.

This two-page tool is the perfect foundation for clear, stress-free financial education and earning!

However, if you want to dive deeper into goal setting and long-term planning, The Allowance Blueprint offers everything in this bundle plus advanced tools like:

- The Savings Planner: For visualizing big dreams.

- My Savings Action Plan: For balancing short-term wants with emergency funds.

- Detailed Guides: For navigating more complex financial conversations with ease.

Stop the nagging and start building Money Masters today!

The Allowance Blueprint

The Allowance Blueprint for Kids is a comprehensive, structured system designed by a working mom and social worker to instill essential financial literacy and responsibility in your children.

More than just a book about pocket money, this guide provides a step-by-step roadmap to create an engaging, educational allowance program that breaks free from the tiring “I want” arguments.