We teach our kids to brush their teeth and clean their rooms, but we often overlook teaching them to check their financial health. Introducing your child to the concept of a Kids’ Financial Audit is one of the most powerful steps you can take toward nurturing a truly healthy money mindset and building lifelong financial literacy.

It sounds complex, but at a kid’s level, an audit is simply a moment to stop, look at the big picture, and make sure their allowance and money management system are truly supporting their goals. Here is your blueprint for teaching this essential life skill.

What Exactly Is a Kid-Friendly Financial Audit?

Forget the scary term. For your child, a financial audit is just a regular check-up on their money. This process is a foundational step in effective personal finance for kids.

It’s a structured time where you sit down with their current allowance, savings jars, and expense trackers to answer three simple questions:

- Where is all the money now? (Savings, spending, giving, etc.)

- Where did the money go since the last check-up? (Reviewing purchases.)

- Is the money moving toward their goals? (Are they on track to buy that video game or big gift?)

The key difference between an audit and their regular tracking is the judgment-free review and the actionable planning that follows.

Why Financial Audits Are Essential for Kids’ Money Management

A financial audit isn’t just about accountability; it’s a profound tool for child development and financial discipline.

It Teaches Self-Correction

If your child realizes they spent too much on impulsive snacks, the audit is the time to identify the problem and create a better plan for next week—before they completely derail a long-term savings goal. It normalizes making mistakes and self-correcting them. This is a core parenting strategy for money.

It Connects Actions to Consequences

Auditing helps kids see the direct link between a specific spending choice (Action) and their current savings balance (Consequence). This turns abstract numbers into tangible lessons about delayed gratification and prioritizing spending.

It Builds a Healthy Money Mindset

An audit reinforces the idea that they are in control of their money, not the other way around. They shift from passively receiving and spending money to actively managing and directing it. This instills financial responsibility.

How to Conduct a Kid-Friendly Financial Audit (Step-by-Step)

You can turn this process into a fun, quick family ritual. This method works perfectly with systems like the Allowance Blueprint or a 4-Jar Money System.

Step 1: Gather the Data (10 minutes)

Collect all their financial components:

- Their allowance blueprint/chore chart (to confirm income).

- Their savings jars or kids’ bank account printouts.

- Their expense tracker (a simple notebook or spreadsheet of what they bought).

Step 2: Compare Income vs. Outflow (10 minutes)

Help your child do the math.

- Total Income since the last audit (Allowance + Gift Money).

- Total Outflow (What they spent + What they saved/gave).

Ask leading questions, such as:

- “Did you earn more or spend more this week?”

- “Is the money you spent equal to what you recorded?” (This checks tracking accuracy.)

Step 3: Review and Diagnose (15 minutes)

Look at their spending with no judgment—just observation.

- For Spending: “Look at the list of things you bought. Are you happy with those purchases, or do you regret any of them? Would you rather have that big toy instead of those smaller things?”

- For Savings: “We need to save $50 for the big LEGO set. At this rate, when will you reach your goal? Can we increase your savings this week?”

Step 4: Create an Action Plan (5 minutes)

The most important step! Based on what you found, decide on one small change for the next period.

- If they overspent: Action: Only take the money for the “Spending” jar when leaving the house this week.

- If they’re behind on a goal: Action: Allocate an extra $2 from their income to the “Savings” jar next payday.

When and How Often Should the Money Audit Be Done?

The consistency is what makes the habit stick. You need a regular financial check-up routine for the best results.

Optimal Timing: Payday

The single best time to conduct a mini-audit is right before or right after their Payday. This ensures they have a clean slate and a fresh injection of cash to apply the new plan to.

Optimal Frequency: Once a Month

While a simple weekly money check-in is great, a formal, sit-down Financial Audit should be done once every 4–6 weeks. This window:

- Is long enough to show meaningful trends in their spending and saving patterns.

- Is short enough that mistakes haven’t caused too much damage to their goals.

- Aligns well with a typical family budgeting or planning schedule.

By making the Financial Audit a regular, normal part of your family routine, you are equipping your child with the mental framework needed to manage their wealth—not just their allowance—for the rest of their lives.

Tired of the endless chore wars?

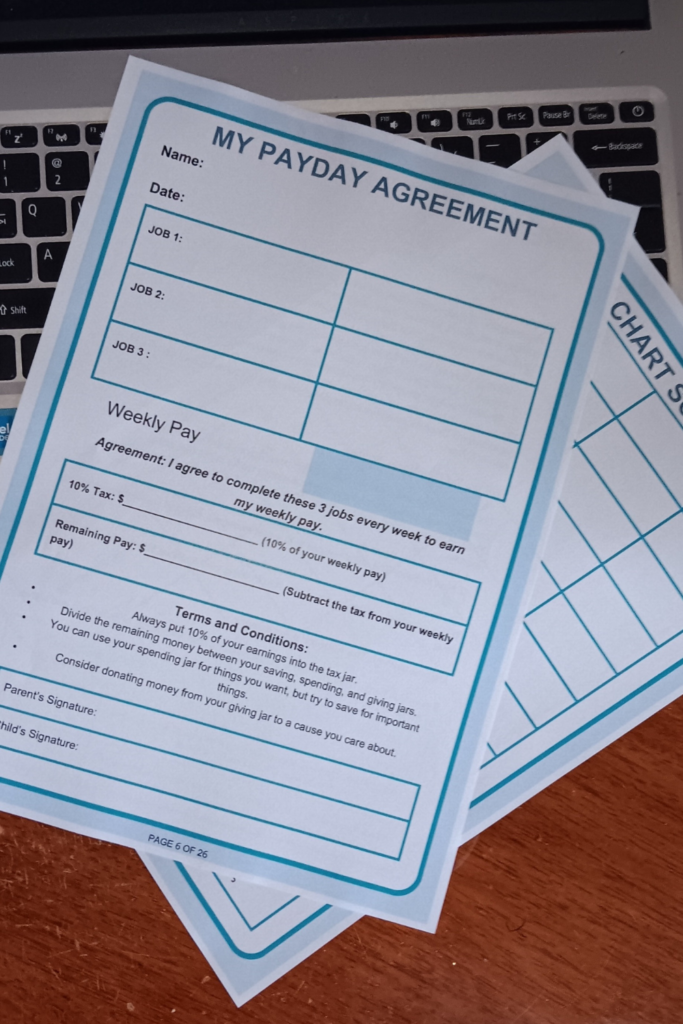

It’s time to replace nagging with a clear, proven system. The Chore Chart Scoreboard & Payday Agreement gives you the complete framework for accountability, earning, and stress-free financial management. Invest in Household Harmony and lifelong responsibility today.

💰 Click Here to Purchase the Scoreboard & Payday Agreement and End the Chore Battles!

Payday Agreement & Chore Chart Scoreboard Bundle: Kids Allowance System for Financial Literacy & Chore Accountability

Stop the chore wars and start building Money Masters!

The Payday Agreement & Chore Chart Scoreboard Bundle is the $5.99 digital download that brings structure to responsibility.

What you get:

- Payday Agreement: A simple contract for you and your child that defines three weekly jobs, introduces a hands-on “tax” (10%), and teaches money division into Saving, Spending, and Giving accounts.

- Chore Chart Scoreboard: A 10-week visual tracker for motivation and accountability.

This two-page tool is the perfect foundation for clear, stress-free financial education and earning!