In our fast-paced world, we’re conditioned to expect everything instantly—from streaming movies to next-day delivery. This has created a challenge for parents: how do we teach our kids to wait for something better when the world tells them they can have it all now?

The ability to delay gratification is arguably one of the most critical life skills your child needs for success, resilience, and financial health. Here is why it matters and how you can nurture it at home.

What is Instant Gratification, and Why Is It a Problem?

Instant gratification is the desire to experience satisfaction without delay. It’s the drive to buy the small, cheap toy right now instead of waiting and saving for the big, expensive one later.

In modern childhood, this drive is constantly fuelled by technology and accessibility:

- The Vending Machine Effect: Kids are used to putting in a dollar (or clicking a button) and immediately receiving the reward.

- Impulse Spending: As they get older, this translates directly into financial habits, leading to debt, credit card max-outs, and a constant cycle of short-term rewards that undermine long-term stability.

- Impact on the Future: Kids who struggle with delayed gratification often battle with poor saving habits, struggle to commit to long-term goals (like career training or retirement savings), and are more susceptible to lifestyle inflation.

The Power of the Pause: Why Delaying Gratification is Important

The famous “Marshmallow Test” proved decades ago that a child’s ability to resist the instant reward (one marshmallow now) for a bigger future reward (two marshmallows later) was a powerful predictor of success.

For your child, delaying gratification means:

- Building Resilience: They learn that waiting is not a punishment, but a strategy that yields a better result. They develop tolerance for frustration and disappointment.

- Financial Discipline: It is the foundation of saving, investing, and avoiding high-interest debt. It teaches them to value their future self over their present impulse.

- Goal Achievement: They develop the focus needed to commit to school projects, skill development, and, ultimately, large financial milestones like buying a house.

Tools for Taming Impulse: Using Goals and Systems

The good news is that the ability to delay gratification is a skill you can actively teach and improve using clear systems.

1. Harness the Power of SMART Goals

Vague goals like “I want to save money” won’t motivate a child to delay spending. Goals must be concrete to make the sacrifice of waiting worthwhile. Teach your child to set SMART goals:

| Letter | Definition | Kid-Friendly Example |

| S | Specific | “I will save for the $50 LEGO set.” |

| M | Measurable | “I will save $5 per week.” |

| A | Achievable | “I need 10 weeks to reach my goal.” |

| R | Relevant | “The LEGO set is the reward for waiting.” |

| T | Time-Bound | “I will buy the set by December 15th.” |

This clear path makes the waiting period manageable and shows the direct payoff of their discipline.

2. Implement a Clear Money System (Like the 4 Jars)

A structured money system removes the guesswork and makes saving automatic. Using a system like the 4-Jar Money Management System (Spending, Saving, Giving, Growing) immediately forces delayed gratification:

- When money is earned, only a portion goes into the Spending jar (instant gratification).

- The largest portion is automatically diverted to the Saving and Growing jars. This physical act of separating the money reinforces the priority of future goals over today’s whims.

Preventing “Lifestyle Creep” as Income Rises

The challenge of delayed gratification doesn’t disappear in adulthood; it simply transforms into lifestyle creep (or lifestyle increase). This is when every pay increase or successful financial milestone is immediately met with a proportional increase in spending—new car, bigger house, more expensive dinners.

The Strategy for Parents and Teens

Teach your kids this rule: Do not let your spending increase at the same rate as your income.

- Automate the Raise: When their allowance or income increases (e.g., they get a summer job raise), the first step should be to automatically increase the percentage going to savings/investing.

- The 50/50 Rule: Adopt a strategy where only 50% of any income increase is allocated to spending or lifestyle upgrades, while the other 50% is automatically directed toward long-term goals (investments, education, or retirement).

By teaching your children to pause and apply logic before they spend their hard-earned money, you are giving them the ultimate superpower to build a resilient and wealthy future, where their long-term well-being always wins over short-term pleasure.

Your Child’s First Steps to Financial Success: A Free Guide to SMART Goals

Ready to turn saving into success? Stop setting vague goals and start building a roadmap your child can actually follow. Download your FREE Guide to SMART Goals “ now and watch your child’s financial focus transform!

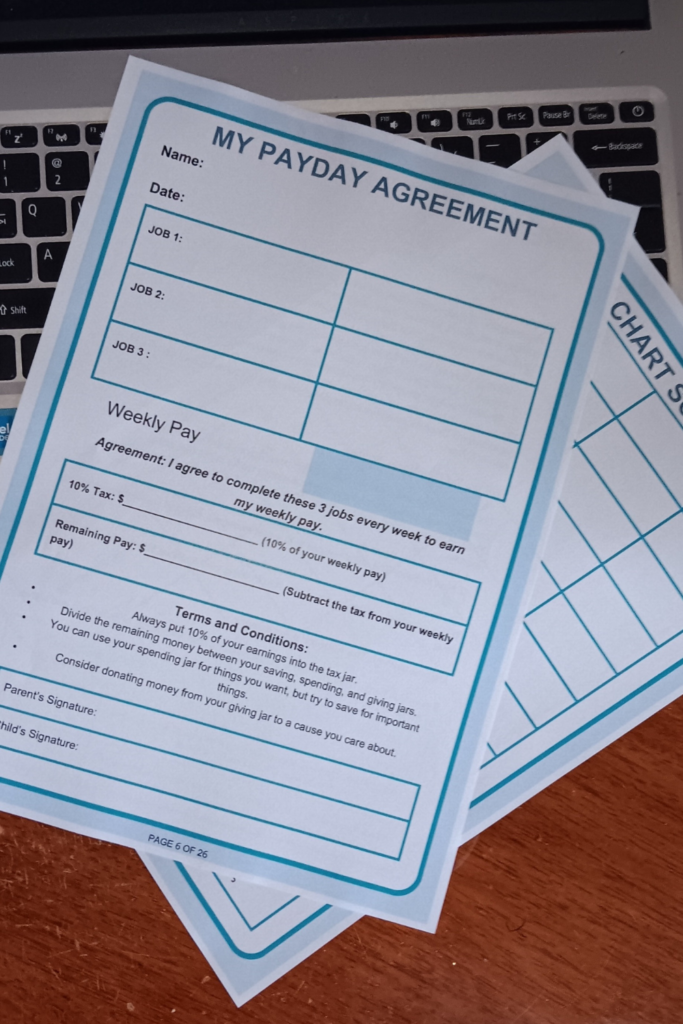

Chore Chart Scoreboard & Payday Agreement (Paid Product)

Tired of the endless chore wars? It’s time to replace nagging with a clear, proven system. The Chore Chart Scoreboard & Payday Agreement gives you the complete framework for accountability, earning, and stress-free financial management. Invest in Household Harmony and lifelong responsibility today.

💰 Click Here to Purchase the Scoreboard & Payday Agreement and End the Chore Battles!

Payday Agreement & Chore Chart Scoreboard Bundle: Kids Allowance System for Financial Literacy & Chore Accountability

Stop the chore wars and start building Money Masters!

The Payday Agreement & Chore Chart Scoreboard Bundle is the $5.99 digital download that brings structure to responsibility.

What you get:

- Payday Agreement: A simple contract for you and your child that defines three weekly jobs, introduces a hands-on “tax” (10%), and teaches money division into Saving, Spending, and Giving accounts.

- Chore Chart Scoreboard: A 10-week visual tracker for motivation and accountability.

This two-page tool is the perfect foundation for clear, stress-free financial education and earning!