Taxes. Just the word can make many adults groan, conjuring images of complex forms and confusing numbers. But taxes are a fundamental part of how our society functions, and understanding them is crucial for everyone, even for children and teenagers. If you’re a parent in Australia (or anywhere else!), you’ve probably wondered how to explain this seemingly dry but incredibly important topic to your kids.

Let’s demystify taxes, starting with why we pay them, focusing on the Australian context, and then looking at how to break it down for different age groups.

Why Do We Pay Taxes? The Big Picture

Imagine a town where everyone lives in their own house, but there are no roads to get around, no schools for the kids, no hospitals when someone gets sick, and no one to put out fires or keep the peace. That’s a pretty chaotic picture, right?

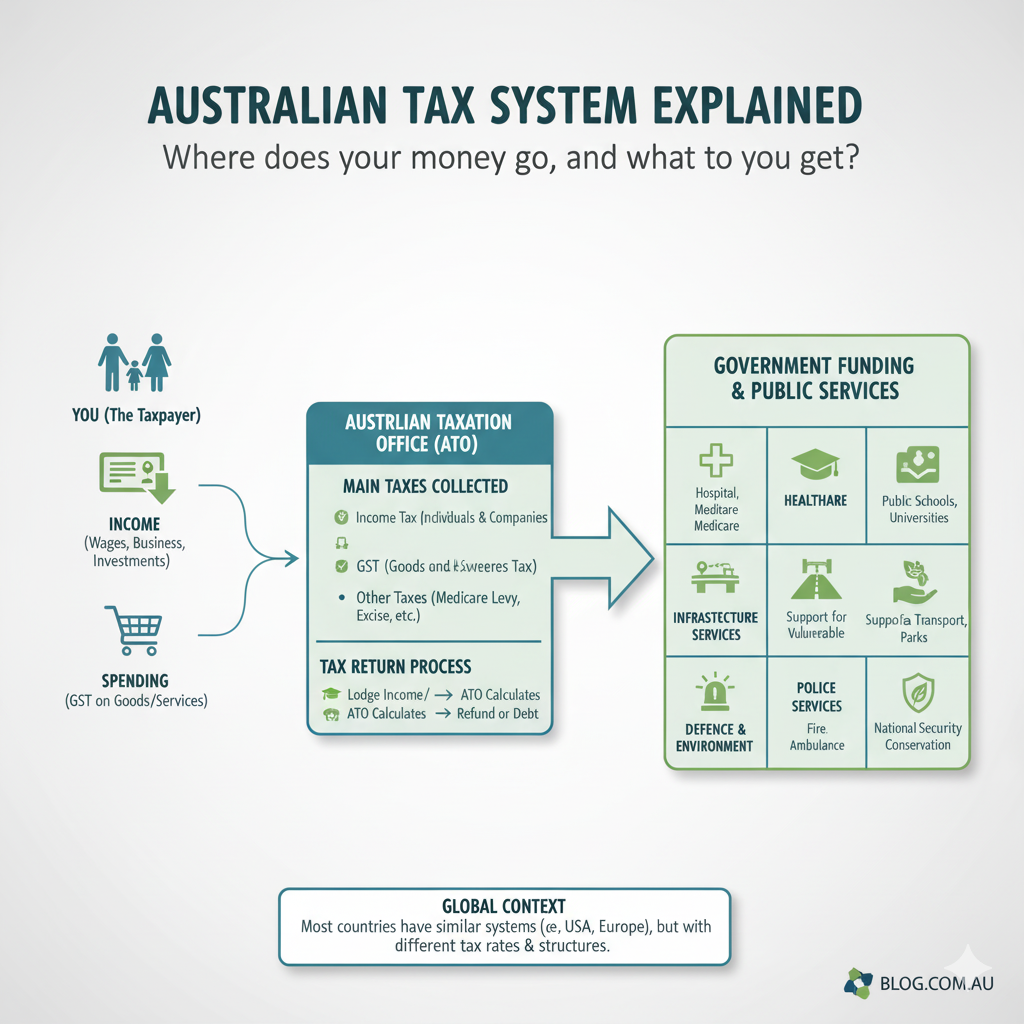

Taxes are essentially our contribution to a shared fund that pays for all the things we need and use as a community that we couldn’t easily pay for ourselves. In Australia, these services include:

- Healthcare: Medicare, public hospitals, and health services are largely funded by our taxes, ensuring everyone has access to medical care.

- Education: Public schools, universities, and educational resources are supported by tax dollars.

- Infrastructure: Roads, bridges, public transport, parks, and libraries – these vital structures and spaces are built and maintained with tax revenue.

- Emergency Services: Police, fire brigades, and ambulance services keep us safe, and guess what? They’re paid for by taxes!

- Social Security and Welfare: Support for those who are unemployed, disabled, elderly, or in need, ensuring a safety net for our most vulnerable.

- Defence: Protecting our country and its interests.

- Environmental Protection: Initiatives to look after our natural resources and combat climate change.

Essentially, taxes are the membership fees we pay to live in an organised society with shared benefits.

Taxes and Your Income: A Quick Look

When you get paid in Australia, you’ll notice that the amount deposited into your bank account is usually less than your gross salary (the total amount your employer agreed to pay you). This is because your employer withholds a portion of your income for tax purposes, sending it directly to the Australian Taxation Office (ATO). This is called Pay As You Go (PAYG) withholding.

The amount of tax you pay depends on how much you earn. Australia has a progressive tax system, meaning the more you earn, the higher percentage of your income you pay in tax. There’s also a tax-free threshold, where you don’t pay any income tax up to a certain amount (for residents, this is currently $18,200).

What is a Tax Return?

At the end of the financial year (June 30th in Australia), most adults need to lodge a tax return with the ATO. Think of it as a financial check-up.

- You tell the ATO exactly how much income you earned.

- You declare any expenses related to your job that you can claim as deductions (like work-related courses, tools, or home office expenses).

- The ATO then calculates if you paid the right amount of tax throughout the year.

If you paid too much tax, you’ll get a tax refund – a nice little bonus! If you didn’t pay enough, you might have a tax debt and owe the ATO money. Lodging a tax return ensures fairness and accuracy in the tax system.

Different Countries, Different Taxes

While the core idea of taxes paying for public services is universal, how countries collect and structure their taxes varies widely. For example:

- United States: Has federal, state, and local taxes, making their system quite complex.

- European Countries: Many have higher VAT (Value Added Tax) or GST equivalent rates and often higher income tax rates to support more extensive social welfare programs.

- Developing Nations: Might rely more heavily on indirect taxes like customs duties.

Each country designs its tax system to meet its unique economic and social needs.

How to Explain Taxes to a Child or Teenager

The key is to tailor your explanation to their age and use relatable examples.

For Younger Children (Ages 5-10):

- Focus on shared benefits: “You know how when we go to the park, the swings are there, and the grass is cut? Our family, and all the other families, put a little bit of money together to make sure we have nice parks, good roads to drive on, and schools for you to learn.”

- Use an allowance analogy: “Imagine if you had an allowance, and every week you put a little bit into a ‘family fund’ to buy something big for everyone, like a new board game or a treat for movie night. That’s kind of like what taxes are for grown-ups.”

- Point out visible examples: When you see an ambulance, a police car, or drive on a newly paved road, say, “See that? Our taxes help pay for that!”

For Teenagers (Ages 11-18):

- Connect to their future: “When you start working, a part of your paycheck will go to taxes. This money isn’t just disappearing; it’s going towards things you’ll use as an adult, like healthcare, public transport, and potentially even your university education.”

- Discuss the “why”: Engage them in a conversation. “What do you think would happen if no one paid taxes? How would we pay for roads or hospitals?”

- Introduce concepts like the tax-free threshold and tax returns: “When you earn your first money, you might not pay much tax because there’s a certain amount you can earn before tax kicks in. And at the end of the year, people do a ‘tax return’ to make sure they paid the right amount and sometimes even get money back!”

- Use real-world events: When there’s news about a new hospital wing being built or a school upgrade, mention, “This is partly funded by taxes.”

- Talk about the social contract: “Taxes are part of our agreement as citizens. We contribute to the collective good, and in return, we get to live in a society with essential services and protections.”

- Consider a practical example: If they have a part-time job, show them their payslip and point out the tax withheld. Explain why it’s there.

Understanding taxes doesn’t have to be daunting. By simplifying the concepts and linking them to everyday life, you can help your children and teenagers become financially literate and responsible citizens who appreciate the value of contributing to their community.