From Tantrums to Tiny Tycoons: How the Saving Seed Money Bundle Transformed My Kids’ Financial Habits

As parents, we all know the familiar scene: the grocery store meltdown, the insistent pleas for the latest toy, the constant battle against the “gimme” mentality. Before I discovered the Saving Seed Money Bundle, my shopping trips were a minefield of potential tantrums, and my wallet was perpetually lighter than it should have been. I knew I needed to do something, not just to save my sanity, but to equip my kids with essential life skills – financial literacy.

I created this bundle as a way to introduce my kids to the world of money, long before they had any real concept of its value. It was designed to bridge the gap between “I want it!” and “Can I afford it?” and to lay the groundwork for responsible financial habits.

The Pre-Bundle Chaos:

Prior to diving into allowances and money discussions, shopping trips were a nightmare. “Mommy, can I have this?” was a constant refrain, and to avoid the inevitable meltdown, I often caved. It was the path of least resistance, but I knew it wasn’t sustainable.

The Saving Seed Solution:

The Saving Seed Money Bundle provided a structured approach to teaching my kids about money. Here’s how it changed our lives:

- The “Can You Afford It?” Reality Check:

- Now, when we’re in the shops and the “I want it!” urge strikes, I simply ask, “Do you have your money with you? Can you afford it?” This simple question forces them to think about the value of money and the consequences of their spending choices. It’s amazing how quickly they learn to prioritize!

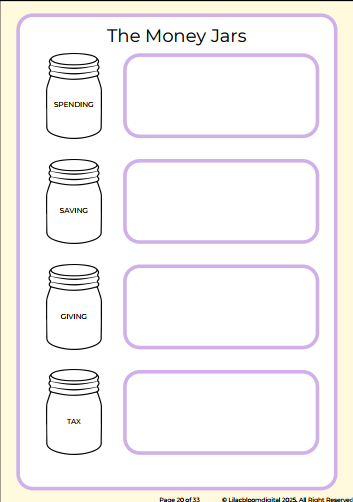

- The Four-Jar System: A Visual Lesson in Money Management:

- The bundle’s four-jar system (Spending, Saving, Giving, and Tax) has been a game-changer. It provides a tangible way for my kids to see where their money is going.

- Spending: This jar is for immediate gratification, allowing them to make small purchases.

- Saving: This jar is for long-term goals, teaching them the importance of delayed gratification.

- Giving: This jar fosters generosity and empathy, allowing them to contribute to causes they care about.

- Tax: This jar teaches them that a portion of their earnings goes towards things that benefit everyone.

- The bundle’s four-jar system (Spending, Saving, Giving, and Tax) has been a game-changer. It provides a tangible way for my kids to see where their money is going.

- The Payday Agreement and Chore Chart Scoreboard: Earning and Responsibility:

- The payday agreement and chore chart scoreboard have instilled a sense of responsibility and the understanding that money is earned.

- Rule #1: No Chores, No Pay: This reinforces the connection between work and reward.

- Rule #2: Jar Allocation: This ensures that money is distributed across all four jars, reinforcing the importance of balanced financial habits.

The Results? Incredible!

My kids are now more mindful of their spending, they understand the value of saving, and they’re even learning about the importance of giving back. The tantrums have significantly decreased, and I’m watching them develop essential life skills that will serve them well into adulthood.

The Saving Seed Money Bundle isn’t just about teaching kids about money; it’s about teaching them about responsibility, delayed gratification, and the importance of generosity. It’s about setting them up for a future of financial well-being.

Want to learn more about the Saving Seed Money Bundle for Kids?

This bundle has been a game-changer for my family, and I highly recommend it to any parent who wants to give their kids a head start in the world of financial literacy.

The Saving Seed Money Bundle For Kids

Grow Your Child’s Financial Future with Saving Seeds!

Our comprehensive kit empowers kids to learn essential money management skills through fun and interactive activities. With a workbook filled with engaging exercises and a parent guide offering expert advice, your child will develop a strong foundation in saving, spending, and earning. Watch as they blossom into financially savvy individuals!